We enable you to make better decisions about your energy operations.

Why power2heat might not succeed

What makes or breaks the future of power2heat? With a higher share of renewables in the Dutch energy mix, the hourly electricity production becomes increasingly weather and season dependent. More and more often the production capacity will exceed the regular demand on an hourly basis, resulting in very low or even negative spot market prices. This could be a cost-effective opportunity for energy intensive industries that need to decarbonize their processes.

One (obvious) option to utilize this excess electricity is to use it for industrial heating purposes, substituting natural gas. Installations like steam boilers can be adapted for dual-fuel use, automatically making a power-or-gas fuel choice based on actual market prices. However, opposite to residential heat, industry processes need higher temperatures that cannot be reached with electrical heat-pumps (that can have an effective efficiency of up to 500%) but require electrical resistors to turn electricity into heat. The efficiency of a resistor is “only” 100%, making the competitiveness with natural gas a much less easy win.

Heat-spread

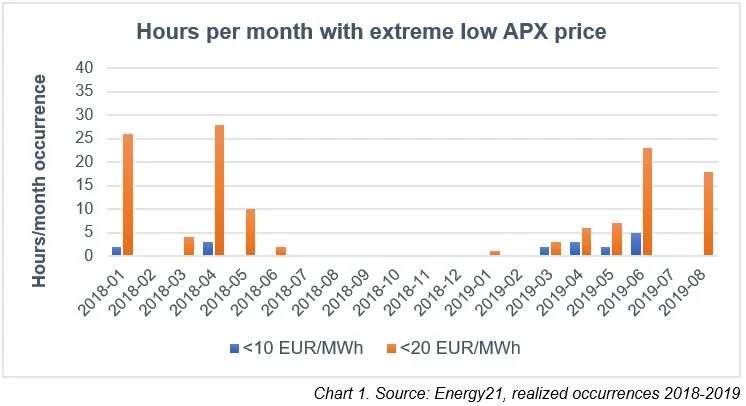

We would like to introduce the “heat-spread”: the difference between the price of natural gas and the price of power in EUR/MWh on the spot market. When the heat-spread is positive, it will be cheaper to use electricity for heating the boilers. When the heat-spread is negative, it is cheaper to use gas. The Dutch market price for gas on the TTF was very low this summer, with prices around 10 EUR/MWh. The ’normal’ prices in recent years were typically in a range of 20 EUR/MWh. This means that the spot market price should currently be below 10 EUR/MWh (or historically below 20 EUR/MWh) for power to compete with natural gas in industrial heating processes.

In the last 18 months the power prices on the APX spot market have shown a few occurrences below 10 EUR/MWh. On average only one hour per month. With a typical installation cost of 10.000 – 50.000 EUR/MW, there is no business case yet for installing resistors. But it is expected there will be much more renewable power capacity connected in the next 10 years. Based on a projection with 20GW solar and 10GW wind power in the Netherlands, we calculated a spot market price scenario for 2030.

This scenario shows up to 2,000 hours per year with very low power prices, on average over 160 hours per month. The main occurrence of these low prices is in the early summer months and December. Theoretically this could reduce the natural gas consumption with almost 25% in industrial heating processes. Assuming an average heat-spread of 10 EUR/MWh, this will save up to 20,000 EUR per MW installed electrical resistor capacity in energy costs. This is not only an attractive business case, since its net payback time will be two and a half years, but could also reduce the CO2 emissions with almost 25% annually.

Power consumption of heat intensive industries

But, the power consumption in most heat intensive industries is nowadays relatively small compared with their consumption of natural gas. The power consumption covers mainly fluid pumps and other baseload applications, so the introduction of large power-to-heat applications (utilized for only 2,000 hours per year) will seriously impact the maximum peak power demand of an industrial plant.

This is an issue, as industrial consumers in the Netherlands pay a monthly fee for their highest peak demand (or “kWmax”) to the grid operator. This monthly fee is based on the highest average peak of the month as measured in a 15 minutes interval. The price differs per grid operator and depends on the connection voltage level but has an average value of about 2 EUR/kW-max per month. Not taking into account, but most certainly having a re-enforcing effect on the conclusion, is the fact that the highest peak in any month triggers a backward effectuated price increase to the new peak level (on average about 16 EUR/kW per year).

Time to act

So, what parameters can and/or should change to make power2heat for industry succeed? Further growth of renewable energy in the Netherlands, at least tripling the current capacity. This is an autonomous trend, expected to happen in the next 10 years. The costs of natural gas shall rise, increasing the heat-spread (specifically the costs of carbon emission. At a carbon price of only 25 EUR/Ton it already adds 5 EUR/MWh). This is an international, or at least European, defined parameter which is difficult to influence. Adapting the kWmax fee mechanism of the used peak grid connection capacity. This parameter has a high impact and requires ‘only’ a change of market agreements.

When the natural gas costs jump to 30 EUR/MWh, the heat-spread can double with a positive impact on the business case. But most important is a shift to a more dynamic fee structure of the grid connection capacity. Time to act for regulators and law makers. One might think of special tariffs for dual-fuel installations, or fee-free periods in times of abundant grid capacity. Such tariff changes can make or break the future of power2heat in the industry. This is in itself a tremendous opportunity in decarbonizing our energy system.

Interested to discuss this topic?

Please contact Michiel Dorresteijn (Principal Consultant) via +31 6 117 169 27 or mail: michiel.dorresteijn@energy21.com

Close

Close

.jpg?resolution=450x275&quality=95)